City Of Seattle Business License Office

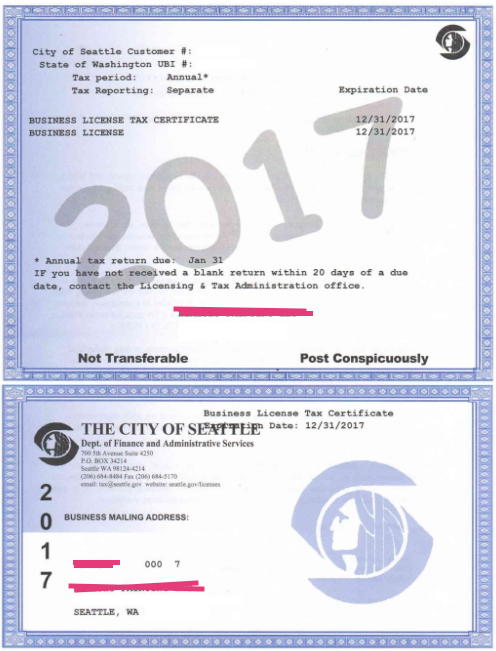

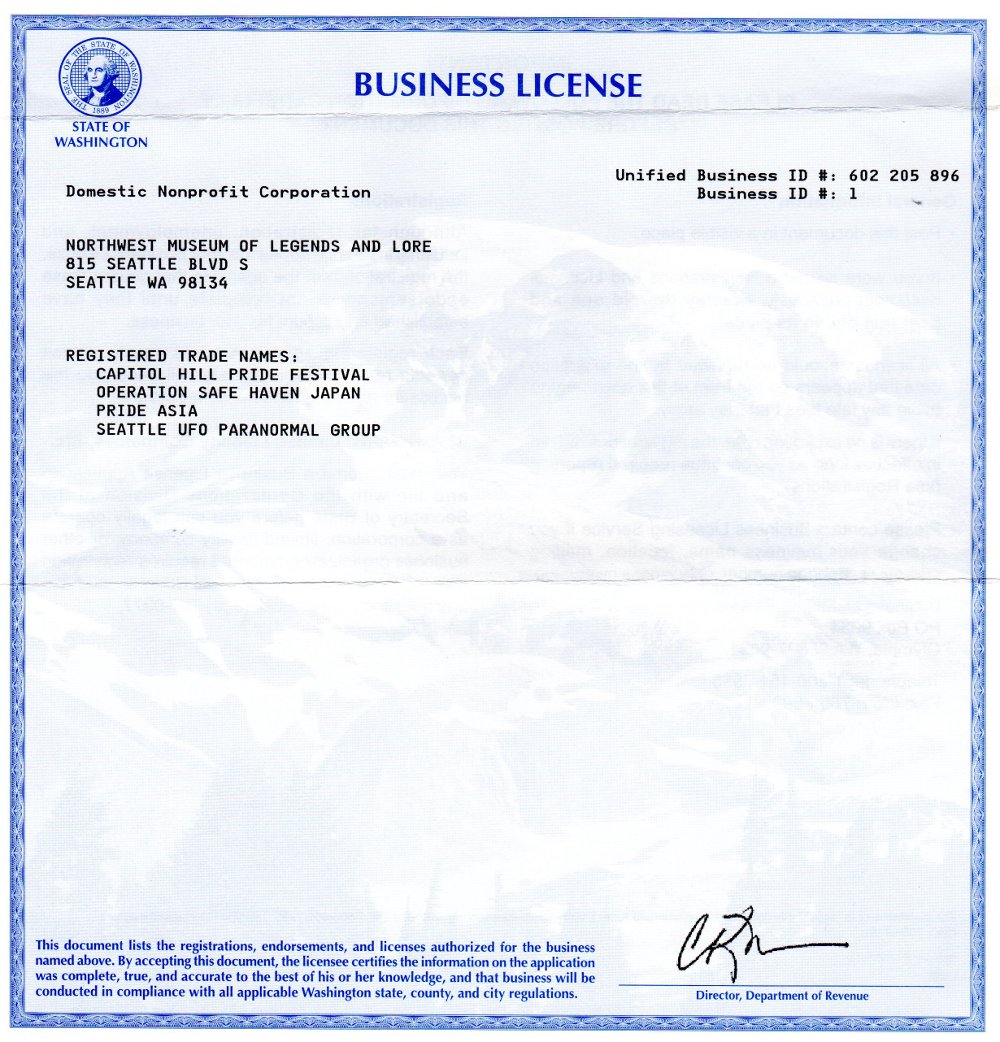

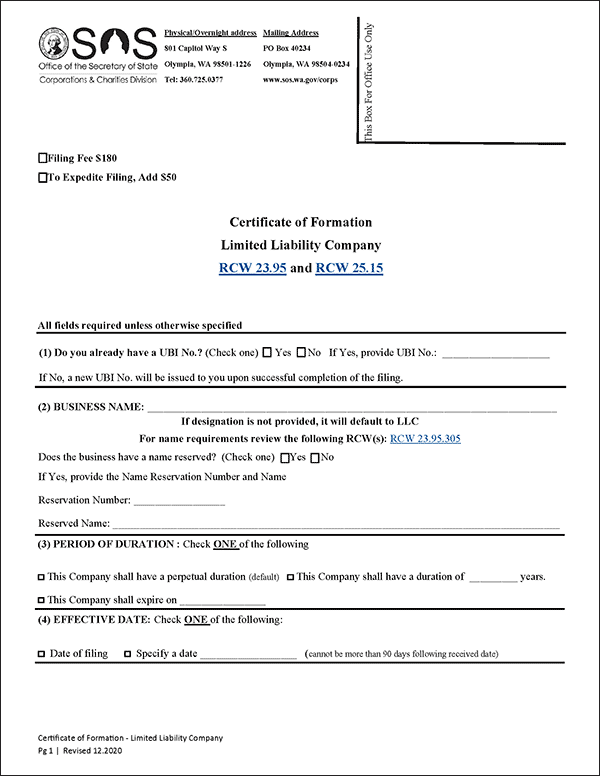

Regulated businesses require both a standard business license tax certificate and a regulatory endorsement added to the license tax certificate.

City of seattle business license office. License your business with the state and the city of seattle determine your licensing requirements. Search the database for licensed seattle businesses. Licensing requirements can change periodically. Businesses operating prior to july 1 with a worldwide gross income of over 20 000 in the current calendar year submit payment of 90.

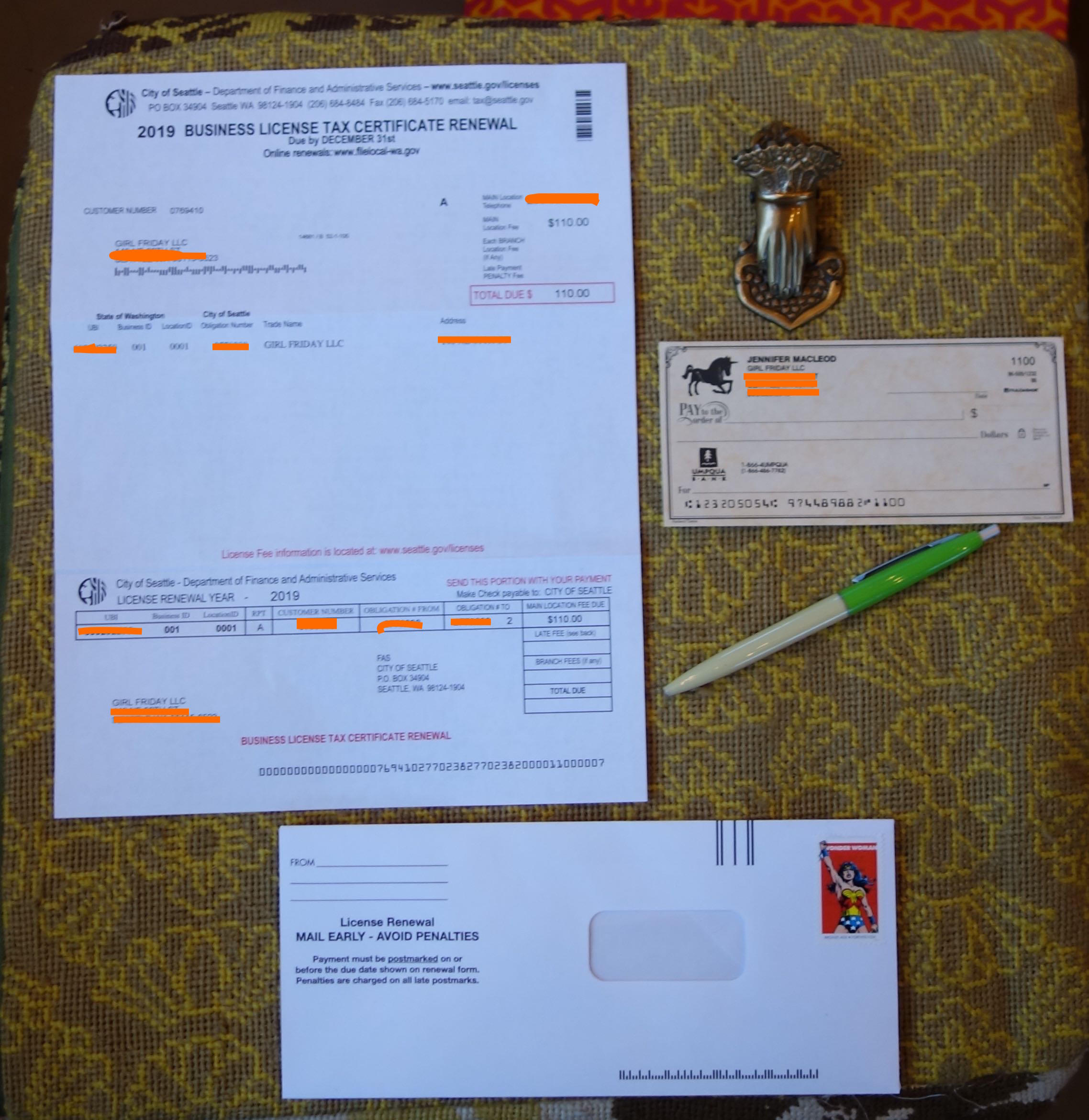

In person visit the business licensing office on floor 42 of the seattle municipal tower 700 fifth ave. The business license application is a single application used to apply for many state licenses and permits and to register trade names. The fee for the city of seattle business license is calculated as follows for the first location plus a fee of 10 for each additional branch of the business located within seattle city limits. You should receive your business license tax certificate in one to six weeks.

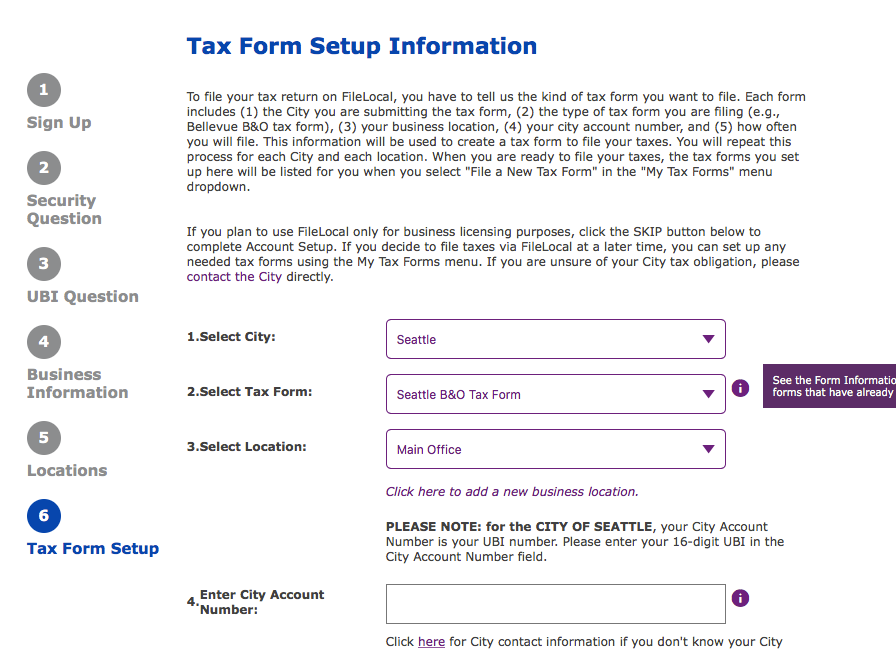

The seattle business license tax certificate database shows you the following information about a business. License tax certificate expiration date. Apply for a license on line. You should confirm your requirements as you go through the application process.

Other specialty regulatory licenses may also be required. Many localities let you apply for a business license using the state of washington business licensing service. You can complete an application pay the fee and in most cases immediately receive your business license tax certificate. You can search by business name industry type or zip code.

Residents of bellevue everett seattle and tacoma may use the filelocal website. For more information or to request a license application please contact the city of seattle at 206 684 8484. For example the city of seattle requires a business license for all businesses who perform services or operate within the city limits of seattle.